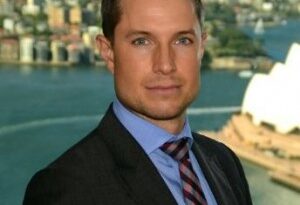

Alvin Fan: “Newer managers underestimate how difficult fundraising is”

OP Investment Management in Hong Kong is busy expanding its business as Hong Kong is bouncing back. HFC’s Stefan Nilsson checked in with OPIM’s CEO Alvin Fan to talk about new strategies being launched, a new joint venture and other growth areas as well as the challenges of raising capital.

OPIM is a leading asset management company based in Hong Kong and a member of the Oriental Patron Financial Group. The company manages both global and Asian-based funds.

What kind of investment strategies are the newest additions to the OPIM platform?

In the last year, we launched two Korean-focused funds and one of the largest digital assets PE/VC funds in Asia of about US$500 million. Meanwhile, Charles Li’s MicroConnect team graduated and spun off the platform last summer, so you can see we’re broadening out quite a bit in terms of strategies, markets and asset classes. We’re also due to launch our first-ever India-focused arb strategy and a second vol fund later, hopefully by the end of the first half of the year. Actually, we have about eight to ten funds slated for release by July. It’s already a very hectic season as we close our first half vintage.

You recently announced a new joint venture with RCM China Consulting and GROW Investment Group. Tell us about it.

We’re going to be rolling out a series of QFI products, designed to maximise onshore access and minimise execution costs, whilst providing curated actively managed hedge fund strategies from the best talent. The partnership represents a triumvirate of market access, execution and advisory. RCM China, headed by Matt Bradbard, brings world-class alternative market access to North American-based institutional investors and money managers. Their trading-oriented culture and half a decade of experience in mainland China give them an execution and infrastructure edge domestically. Meanwhile. GROW, headed by William Ma, has decades of experience advising institutional investors on allocation strategies, making their advice and on-the-ground due diligence capabilities quintessential. OPIM is bringing together QFI management and SFC regulatory confidence.

OPIM is now firmly established as a leading fund platform in Hong Kong. How do you think OPIM will continue to grow from here?

2023 is not just a year of rebounding launches, but we’re also building. Virtual asset management is going to be an important area – not just in trading coins, but more importantly the tokenisation of assets. The disruptive nature of blockchain technology could be a catalyst to accelerate Hong Kong’s existing capital market strengths. That’s not entirely in our hands of course, and we need help from the administration, but the private market probably needs to assert itself in this area. We’ve also started expanding into private equity strategies, an area which we’ve typically shied away from due to the litigious proclivities around subjective valuation, but we’ve had a chance to tune our regulatory policies over the last few years with institutional investors, so we’re in a much more prepared position than we were eight years ago. Finally, we’re going to be expanding our ODD services with a new product launch later this year. It’ll be a cool little project that investors will find useful.

OPIM is very active in helping the funds on its platform with cap intro through events, market intelligence and investor meetings. How crucial is it for newer managers to have solid support when it comes to capital raising?

Most newer managers underestimate how difficult fundraising is and our industry tends to pat ourselves on the back more than we deserve. Money managers spinning out of larger shops often overestimate their market value and loyalty of their clients, assuming most would follow them into their new shop with 1:1 allocations, but are disappointed when they finally raise just a fraction of their target. With the pedigree halo effect fading, the manager needs to fall back on the fundamentals of marketing: positioning, articulation and transparency. Performance is just a minimum requirement. So having a comprehensive marketing program that helps manager entrepreneurs refine their messaging and maximise exposure is essential to survival through their first few years of building a track record.

OPIM is one of the long-standing sponsors of the Hong Kong Hedge Funds Club. On 18th May, we will once again be gathering HK’s smartest investors and best fund managers at the China Club. Do you think that your fellow Hongkongers in the hedge fund industry are up for some social fun again after a few quiet Covid years?

Hong Kong is already back in full swing and the city is absolutely buzzing! I know the Hedge Funds Club team is looking to turn it up a notch in May and OPIM will be there!