Scott Treloar: “We need a new theory of business”

Noviscient’s Founder and CIO, Scott Treloar, talks with Hedge Funds Club’s Stefan Nilsson about how the asset management needs to change to better serve its investors.

Scott is the Founder and CIO of Noviscient in Singapore. He has lectured on portfolio risk management at Henley Business School and was Chief Risk Officer at Vulpes Investment Management. He co-founded the hedge fund Novalis Capital and his career has also included stints at Deutsche Bank, Committed Capital and Macquarie Bank.

You are passionate about changing the asset management industry for the better. What is the driver behind this? What made you think that enough is enough and it is time to initiate change?

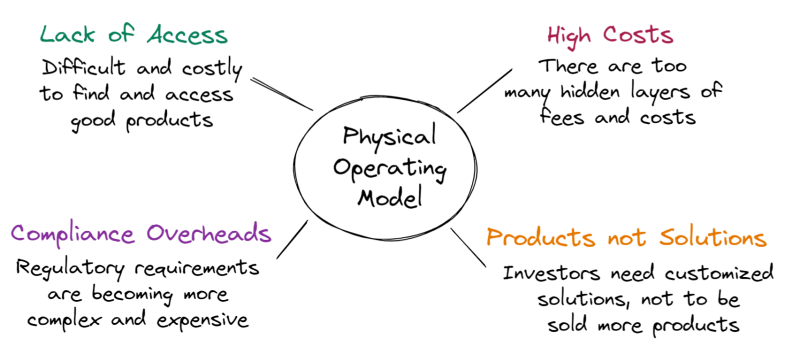

In the 1990s, a management thinker called Peter Drucker introduced the concept of a “theory of business” that talks about firms’ assumptions about how the world works. Sometimes the assumptions lose validity and if the firms don’t adapt to the new world, they will fail. Kodak’s failure to adapt to digital photography is a salient example, but there are many others. The asset management industry’s theory of business is focused on growth in assets under management (AUM) rather than creating value for clients. The industry continues to push out more products, grow through acquisition, and integrate forward to try to capture more client investment dollars. Unfortunately, this is a business model from the last century. It is an inefficient, physical operating model that has a multitude of shortfalls and problems.

Nowadays, investors are far more demanding. They are looking for customised solutions that meet their needs. The solutions should offer access to quality products in a seamless way with much of the work happening under the hood. They want fee structures that ensure an alignment of interest between the managers and the investors. To meet these needs, we need a new theory of business for asset management that does two complementary things. Firstly, the industry should stop seeing investors as a source of AUM and start seeing them as clients and putting them first. Secondly, it takes advantage of the availability of cloud computing, open-source software and various machine learning techniques coming to enable a digital operating model for the industry.

What big shifts in how the asset management industry works do you want to see in the coming years?

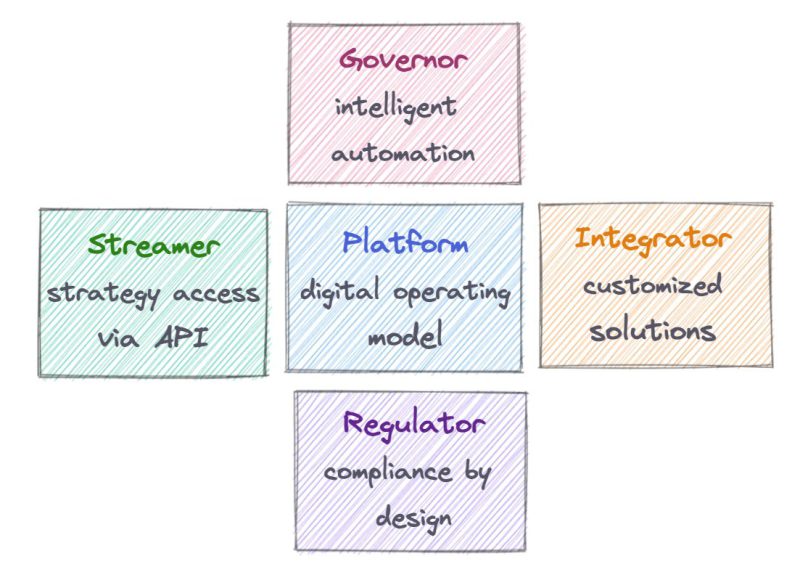

The overarching shift is for the industry to become client-centric, rather than seeing clients as a source of fees. This mindset change is fundamental to the other shifts that I discuss. Being client-centric means focusing your efforts on creating value for clients and sharing in some of that value. I see this as an honest business model. Historically, significant change comes from collections of complementary innovations, rather than any one innovation. To bring asset management into the 21st century, we see the following collection of innovations or shifts as important. Note that we give them names to facilitate discussion.

Firstly (platform), the industry needs to progress from its current physical operating model populated by manual processes and spreadsheets and move towards an end-to-end digital operating model. Note that this doesn’t just mean automating existing processes. It means using digitisation to imagine new and better ways of creating value for clients that are increasingly low-cost and frictionless. The second shift (streamer) is to move to more of a streaming data model using APIs and portals to connect with third parties. Getting validated data efficiently into your platform from third parties is important. A third shift (regulator) is rethinking how asset management firms engage with regulators. As currently practised, compliance is an expensive tick-the-box activity that is concerned with form over substance and is often put in place after the fact. Some firms even see the fines from compliance failures as a cost of doing business. Instead, asset managers need to dynamically link the various rules and regulations directly into the digital operating model processes to enable a state of ‘affirmatively compliance’. That is, being able to quickly and transparently demonstrate compliance with each and every rule and regulation. A fourth shift (governor) that leverages the digital operating model is a framework for finding and implementing decision policies. It allows the proper use of data, models, and learning to find the best decision policies for the firm based on both back-testing on historical data and simulating forward. This intelligent automation enables significant economies of scale and scope which allows firms to offer cost-effective solutions to small and large investors. The fifth and biggest change (integrator) is to leverage these shifts I have referred to above to democratise access to sophisticated investment services for every investor, large or small. That is an online engagement model that brings together an investor’s situation and requirements with selected investment products to create customised investment solutions that adapt as requirements and markets change. This is the holy grail of investing and where we are headed. In a future article, I will provide more details about how we are implementing these initiatives at Noviscient as we reimagine investment management to put clients first.