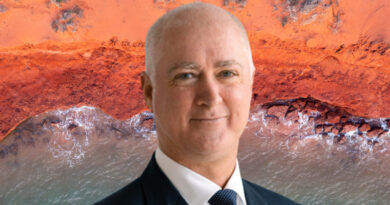

Kim Rosenkilde: “Energy transition is the biggest opportunity of the decade”

Danish-born and Singapore-based Kim Rosenkilde, Singlife with Aviva’s Group CIO, talks with Hedge Funds Club’s Stefan Nilsson about his career, the opportunities and threats in investment management, the role of technology, investor needs and much more.

Kim Rosenkilde was appointed Group Chief Investment Officer at Singlife with Aviva in 2021. Kim leads the firm’s investment management activities. He has previously held senior executive roles with ICAP, Deutsche Bank and ABN AMRO Bank in London, New York, Tokyo and Shanghai, always with significant risk, regulatory and revenue responsibility. Kim is also Chairman of Navigator Investment Services Limited, a Singapore Life company.

Immediately prior to taking on the CIO role at Singlife with Aviva in 2021, you worked with a few smaller, nimbler investment firms such as Noviscient and RKR Capital. Has it been difficult transitioning from boutiques into a bigger financial firm again?

I had always worked for very large and global institutions prior to getting involved in startups. There was certainly a bit of miscalculation on my part, as to how difficult it would be to get access to decision-makers for smaller and innovative platforms such as Noviscient. Therefore, I approached my new role with an appreciation of just that, but possibly also a bit of underestimation about how much time my new stakeholders would need to get comfortable with innovation, and for me, to understand the process of my actuarial colleagues. It has been a steep learning curve, but I am confident that the end result is of mutual benefit to the company and most importantly, to our customers.

When the opportunity of a big role at Singlife turned up in your life, did you have to think about it or was it an immediate “Yes”?

More than just thinking about it, I sought a lot of advice from others. I was acutely aware of the responsibility of handling “real people’s money” which weighed heavily on my mind. My career originated in dealing with large central banks, sovereigns, asset managers, hedge funds, etc, mostly as a liquidity provider, so the thought of taking on the stewardship of “real” money, people’s savings, was not an easy choice. I have a small little item in my office that I look at every day to remind me that my job is just that – guardian or steward of other people’s future. That may be the reason I ask so much of our external managers.

What do you think are the biggest opportunities in investment management right now?

I think the energy transition is the biggest opportunity of the decade. The public-private partnership must achieve that. Sovereigns must finance greater military spending and decrease reliance on the supply of fossil fuel from other sovereigns whilst facing possibly lower tax receipts and social unrest. I am aware there are no sovereign guarantees nor involvement in the cap deck, but I am certain the sovereigns’ interests are very aligned with investors. Moreover, the regulatory capital treatment of ESG-related investments must be addressed and I am certain it is already taking place. That means a revaluation of such investments. From an insurance/pension portfolio point of view, this is incredibly beneficial.

And what are the biggest obstacles?

How? We use external managers and there are few with a long track record in this field. Private credit and private equity have had a decent time to build both credentials, but also a diversified portfolio. Comparatively, energy transition is relatively new and sourcing investment is a challenge for managers. We are very public about the managers we choose, and we use consultants like Albourne, and also rely on colleagues from our community whom we might meet through SBAI. We are a young company from an investment angle, and truly believe we can learn from participating in industry forums.

What role does technology play in your role at Singlife and for your customers?

We are making substantial investments in this field. Not surprisingly, there are some significant advantages for the last mover. We are currently, after a very comprehensive RFP and man-hour spend, about to announce our partner for front/mid/back-office technology in the investment office. This will enable us to have full transparency of our external managers, understand risk, select new managers and improve returns.

At Singlife you deal largely with retail investors, a market segment which includes a wide range of customers with different levels of financial literacy as well as risk profiles and risk appetite. How do you as the Group CIO take that into account in order to have investor-appropriate solutions?

We have built a team with a significant focus on quantitative skills and industry knowledge. We are not sure there is enough understanding of the risk embedded in products today and we set out to spend most of our effort to ensure this is front and centre of everything. As a company, we are dedicated to the financial wellness of our customers. Transparency is the first requirement for that. Singapore also benefits from a regulator that has the same focus, and we have a great relationship with them, as with other government entities.

How closely does the investment team work with your client-facing representatives? Do you have a proper feel for what the end investors’ needs are?

I chair our platform, Navigator. It serves around 5,000 financial advisors and is licensed to transact CPF funds. I always think of Navigator and our Investment Office as Siamese twins. Our Investment Office approves new funds on the platform, but also builds portfolios for financial advisors. We are also very present at financial advisor events, and this will only expand over time. We were adamant that we wanted to hire from financial advisor offices, precisely to understand the mindset of our customers, but also to understand the obstacles an advisor faces every day. As a company, we are addressing that through a myriad of functions, and this stands at the core of the firm.

When it comes to alternative investments, such as hedge funds, private equity and venture capital, do they currently feature in any form in what your clients can access via your platforms? Do you see retail demand for alternative investments?

There is certainly a lot of demand for it, but we are also conscious that we need to explain/elaborate/educate our customers first. As a traditional life insurance investor, we can take on illiquid investments as long as we get paid a premium for that. I am concerned that there is a misappreciation of the liquidity aspect and really want to address that at first. Of course, there is a very useful purpose for alternative investments in a retail portfolio, but you have to stay true to your mantra of making sure the customer understands the product. That is first and foremost our responsibility.