MainNet Capital’s Elon Huang: “No one likes a loser”

Elon Huang is the Founder and Chairman of MainNet Capital in Singapore, a tech-loving finance house that, among other things, manages the MountView Managed Futures fund. Hedge Funds Club’s Stefan Nilsson decided to have a chat with Elon.

Elon founded MainNet Capital in Singapore in 2017 following a career in private banking and wealth management with OCBC Bank and United Overseas Bank. MainNet leverages technologies such as artificial intelligence, cloud computing and big data in its business. MainNet Capital has multiple lines of business including wealth management, asset management, fund management, a global open platform, and internet finance, providing high-net-worth customers with all-rounded financial services. Its product line-up includes the in-house MountView hedge fund strategy.

Why did you leave your life as an employed banker to launch your own finance house?

I started MainNet Capital in 2017 as my start-up company here in Singapore. One of the key reasons for doing this, and the main driver to wake up daily, are the people I work with and the joint goal we are going after. We are all living a life with a limited and uncontrollable length. However, we can try our best to expand it with infinite passions and dreams. We can make each day count and fill our lives with values.

What can you tell us about the MountView Managed Futures strategy?

It employs a volatility risk premium (VRP) strategy to generate alpha returns. Our research shows that hedging instruments that provide protection against downside exposures such as options, tend to trade at a premium. Our VRP strategy is able to exploit these risk preferences and behavioural biases by systematically selling those options while dynamically hedging the risk exposures. The alpha of the VRP strategy exhibits a low correlation to many traditional and alternative return sources. Moreover, the anti-fragile characteristics of our VRP strategy make it more robust in the current macro environment.

The fund has been live for about 11 months now. Has the fund behaved in line with expectations so far?

The fund with the strategy we are trading was live for the past four years actually. In 2021 we decided to launch it as an official fund in the market. The fund’s behaviour has matched our expectations. Our targeted return for the fund is 15%-20% per annum. And we have achieved around 18% last year. The Sharpe ratio we target is 2 and the fund’s Sharpe ratio is at 2.3. The max drawdown we are targeting is 5%-10% and the fund’s max drawdown so far is only 3.2%. Instead of saying that the fund is matching our expectations, we would like to say it’s beating and going beyond the expectations.

What is your main philosophy around risk management?

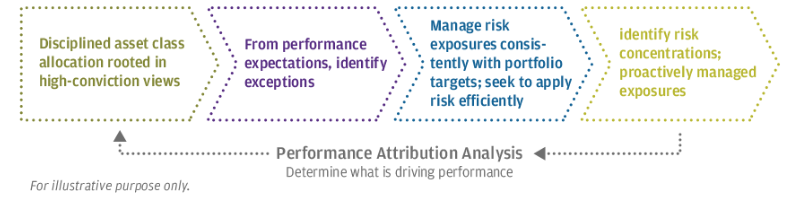

We use delta, gamma and vega multi-strategy hedging, and with the butterfly spread trading algorithm, etc. Highly disciplined risk management and risk budgeting are essential to our entire investment process. Dedicated risk managers interact with the portfolio management team to analyse each trade before it is implemented. In addition to calculating and tracking traditional industry-wide measures of portfolio risk and risk efficiency, the nature of our investments and frequency of underlying performance updates dictates a customised risk management approach. This includes setting a risk budget, measuring its utilisation and stress testing portfolios. Our integrated risk management process gives the team greater insight into the sources of portfolio risk, helping us to identify the risk-based factors that ultimately drive performance based on our market view.

When it comes to your quant models, are you continuously fine-tuning them to improve the investment strategy’s performance?

Yes, we do algorithm fine-tuning on a regular basis to make sure the strategy matches the best market moves and generates the best performance.

Your fund is operating under Singapore’s new-ish VCC structure. Is it as efficient as they say it can be?

Yes, the Singapore VCC is operating under the same logic as the Cayman SPC structure. That’s why, although the VCC structure is new, it could operate with the same high efficiency as the SPC had previously.

In your opinion, what does it take to become an excellent quant investment manager? What are the skills needed to succeed in such a role in our industry?

Hard skills: This depends a lot on the type of fund manager you want to become.

Very strong knowledge of math, statistics and probability.

FRM works better than CFA in this case.

Knowledge of programming languages like Python, R and .NET.

Knowledge of basic tools like MATLAB, Mathematica and SPSS.

A strong understanding of financial theories like CAPM, modern portfolio theory, etc.

Working knowledge of market microstructure.

Previous experience as a successful trader or portfolio manager.

Soft skills: Apart from normal stuff such as being a great team player, likeable personality, analytical mindset, some specifically desired traits are:

Not projecting stress. If you’re losing money, you have to handle it yourself. Your co-workers won’t be around consoling you for long. No one likes a loser.

Ability to not get overwhelmed by information overload.

Ability to fire under-performers.

Being humble. If you’re on a winning streak and very vocal about it, your peers might get jealous and start disliking you.

Not being too opinionated. Strongly opinionated people tend to base their decisions on intuition or experience rather than data. This works for Warren Buffett because he’s a genius, but it doesn’t work for most people.