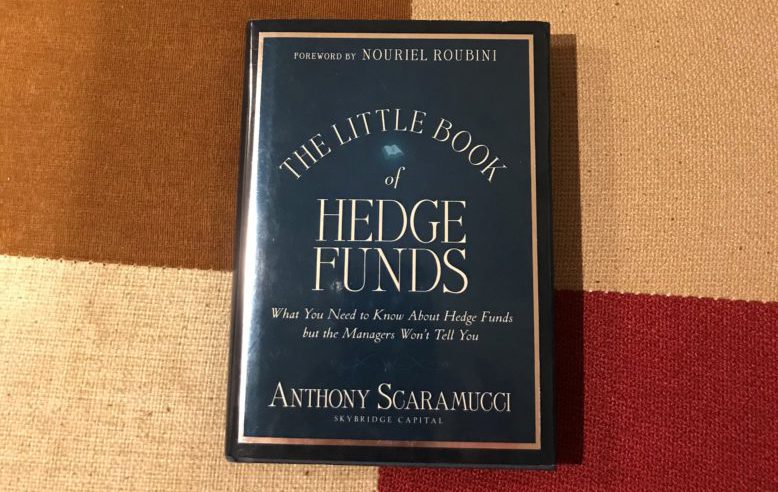

Book review: “The Little Book of Hedge Funds” by Anthony Scaramucci

A hedge fund industry overview by one of the most colourful characters in the business. The Mooch’s book has aged well and is as relevant and useful as ever.

By Stefan Nilsson

Anthony Scaramucci, or “The Mooch”, is one of the hedge fund industry’s more colourful characters. He is larger than life. He is loud, over the top and he wears ties that only former salespeople from Goldman Sachs would wear. But – and this is a big but – he can back it up. He has succeeded in building several great businesses in the hedge fund industry. He has made plenty of money for himself, his partners and his investors. He has earned the right to be at the centre of attention. Scaramucci is a showman, an entertainer, which is something he uses very well to his advantage when he hosts his legendary SALT conferences (events that always seem to combine hedge funds and celebrities). He’s the Fred Astaire of the hedge fund industry. In more recent years, he became known also outside of the hedge fund industry when he had a brief – as in really bloody short – stint in Donald Trump’s White House. That new career lasted only days and Scaramucci swiftly returned to his old role at SkyBridge Capital, the alternative investment firm he co-founded in 2005. Prior to SkyBridge, he founded Oscar Capital Management which he later sold to Neuberger Berman. He got his grounding in the industry working at Goldman Sachs following his education at Tufts University and Harvard Law School. He also spent a few years at Lehman Brothers after they acquired Neuberger Berman.

I was given this copy of “The Little Book of Hedge Funds” some years ago during a Tokyo visit by Scaramucci. Re-reading the book now is a pleasant experience. The book, published in 2012, has aged well. None of its content has become obsolete. It’s a great read for those who want to understand the hedge fund industry. All the basics about investment strategies, manager selection, due diligence, portfolio diversification and so on are in there. So are the history lessons, including stories around industry people such as AW Jones, George Soros, Paul Tudor Jones, Cliff Asness, John Paulson, Julian Robertson, David Swensen and many more. Scaramucci is experienced and he shares a lot of great information in this book, including SkyBridge’s due diligence questionnaire. He also serves us plenty of personal anecdotes and stories in the book. He is a great storyteller and thus it’s an easy and enjoyable read. The book contains many great one-liners, such as “Theories are like assholes – everyone’s got one” and “Wall Street has a reputation for being a cutthroat place for a very good reason: It is.” My favourite line in the book is: “Mutual funds are Berlin with the Wall, while hedge funds are Berlin with all the swank art galleries.” If you are interested in an overview of how the hedge fund industry works and its history, this book is very handy. I highly recommend it, even as a refresher for those of us who have been in the industry for a few decades. For those who want to join the industry or are new to it or consider investing in hedge funds, this is essential reading. The Mooch has got you covered.

Stefan Nilsson is the Founder and Editor of the Hedge Funds Club.