Interview: Cameron Brandt, Research Director, EPFR

A discussion with Cameron Brandt, Research Director of EPFR, about GDP growth in the US, managing volatility, Indian growth, central banks’ monetary policies, crypto mandates, yield hunger and much more.

Based on the March FOMC meeting, the Fed sees US GDP growth exceeding 6% this year with only a transitory effect on inflation. What are fund flows and allocations saying about this narrative?

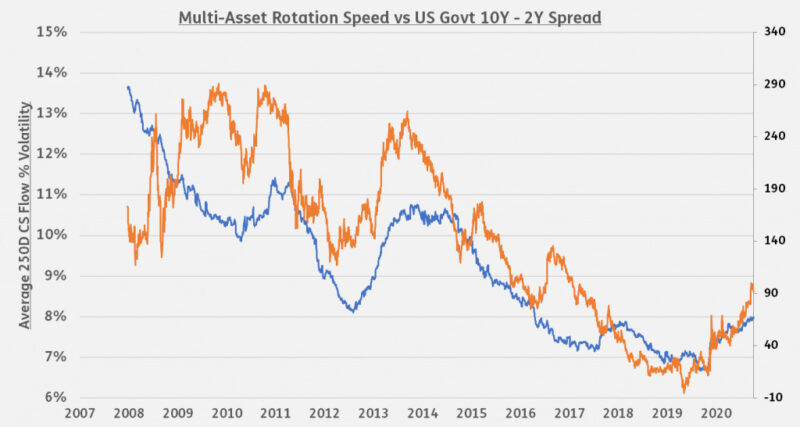

There’s still no real appetite to “fight the Fed”, March’s spike in 10-year Treasury yields notwithstanding. But investors have been sceptical for some time that the extraordinary monetary and fiscal policies, deployed to limit the economic impact of the pandemic, won’t have an inflationary sting in the tail. EPFR-tracked Inflation protected bond funds saw a sharp and sustained pick-up in flows in late June of last year. Since the beginning of 3Q20, this fund group has recorded only two weeks of outflows – the current run of inflows is the longest in over a decade. The tension between the broad reflationary narrative and the concerns about higher inflation is contributing to volatility levels. A measure of volatility developed by EPFR that links price volatility and the intensity with which investors rotate between asset classes shows that the multi-asset rotation speed has been picking up for over a year.

In their search for the drivers of this shift, EPFR’s quant team found that the spread between US 10 and 2-Year Treasuries – a classic measure of inflationary expectations – has the tightest correlation with the asset rotation measure.

What are the best options for managing this volatility?

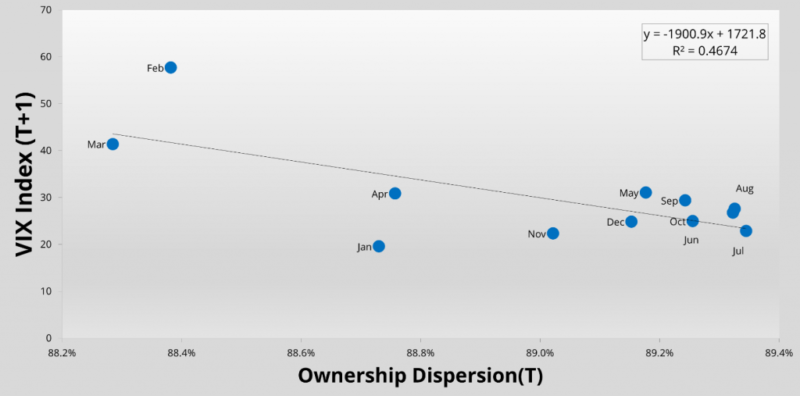

Outside of the standard approaches – low beta funds, for instance – EPFR’s quant team determined that focusing on ownership patterns can provide important signals. During 2020, research by EPFR shows that average ownership dispersion of the market was a good predictor of overall market volatility. As can be seen in the chart below, the Ownership Dispersion index for Russell 2000 stocks has performed well as a front-runner for the one-month forward VIX Index. Months with higher average ownership concentration in the market has been followed by higher volatility, whereas higher dispersion was followed by lower volatility months.

Is the COVID-19 pandemic last year’s story? Or does it remain the key variable for the global economy?

The pandemic remains a key variable. You only have to look at India’s current spike, or the impact the latest waves are having on European economies. But, from a flows and allocations perspective, it seems that investors are more concerned about COVID-19’s impact on economic policymaking than they are with its impact on month-to-month macroeconomic numbers. Recent examples include Brazil, where flows to dedicated funds held up until the country’s pandemic story became so bad it squashed hopes that President Jair Bolsonaro’s administration will resume its reform agenda in order to revive the economy. In Europe, we’ve been seeing Spain and Italy funds attract new money, despite their current situation, as investors focus instead on the policy responses.

What are you making of India’s experience?

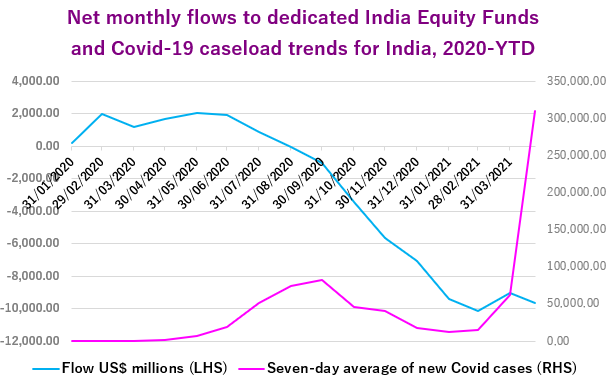

The dramatic acceleration of India’s COVID-19 caseload during the past month has certainly reminded markets that the question of whether post-pandemic growth constitutes a short-lived rebound or lays the foundations for a sustained recovery can still be rendered moot. In its January World Economic Outlook, the IMF projected India will post 11.5% growth this year and it upgraded that number to 12.5% in its April update. Private forecasts have recently fallen into the 10-11% range. Mutual fund investors, however, were already treating India’s reflation story with some caution. Infections during the first wave peaked in mid-September but dedicated India equity funds did not see flows rebound until well into 1Q21.

Among the developed markets, where are the pain points?

Europe made the slowest recovery from the great financial crisis, which made it more vulnerable to the economic consequences of the pandemic. Furthermore, it has been hit by second and third waves of COVID-19 infections. At the country level, investors have been flagging France as a major risk for some time. Since the beginning of 2018 dedicated France equity funds have recorded outflows on average six of every seven weeks. Fund managers have been more bullish, largely maintaining their allocations to France. Japan continues to be supported by extremely high levels of monetary and fiscal stimulus. But for a country wrestling with the economic consequences of an ageing population and a general reluctance to prioritise consumption over savings, the pandemic complicates the search for long-term solutions.

Who are the current winners since the pandemic began?

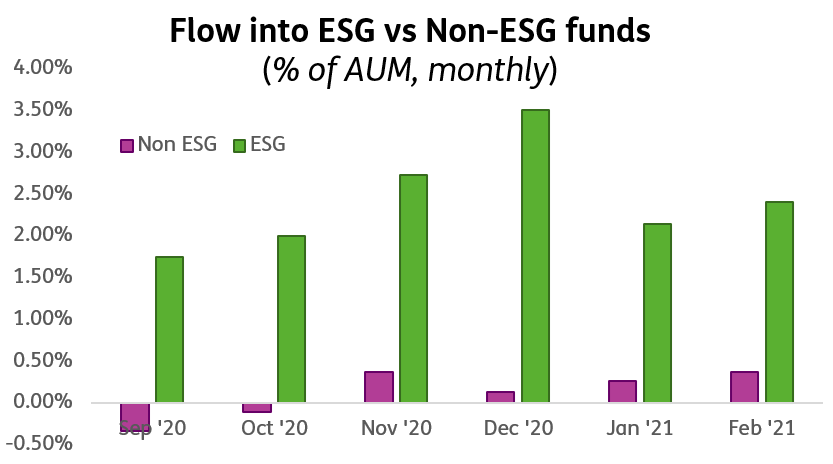

In broad terms, any fund with a credible socially responsible (SRI) or environmental, social and governance (ESG) mandate. EPFR-tracked SRI/ESG equity funds have recorded inflows 51 of the past 52 weeks. Over the past five years, they have enjoyed positive flows more than 50% of the time, with that percentage increasing steadily. In addition to consistent and growing investor appetite, SRI/ESG assets increasingly reflect the views of “city hall”, enjoying growing levels of financial and regulatory support from governments around the world.

Among the bread and butter fund groups, those with diversified mandates have fared best when it comes to attracting fresh money. During the third week of April, global equity funds – the largest of the diversified equity fund groups – recorded their 43rd straight inflow. A run that has seen global equity funds absorb over $50 billion from retail investors and more than $250 billion overall. Investors have also shown considerable conviction at the sector level, starting with technology and healthcare sector funds in the immediate aftermath of the pandemic. Currently, financial, industrial and infrastructure sector funds are sitting on lengthy inflow streaks.

Do any central banks currently have the luxury of running a conventional monetary policy?

Given the response we saw to signals by Chinese officials that their country’s post-pandemic recovery is far enough along for them to consider a degree of policy normalisation, the answer is no. China equity funds, which recorded nine straight inflows leading into the annual National People’s Congress, have now posted outflows four of the past five weeks. Emerging markets equity funds collectively started 2Q21 with only their second outflow since mid-September. For the most part, markets will likely react badly – think 2012-14 “taper tantrum” – though you could argue some modest signs of fiscal discipline in the US would be welcomed. This question of normalisation is particularly acute for Europe and the Eurozone, given the north-south divides and the German Constitutional Court’s discomfort with the ECB’s de facto monetization of sovereign debt.

How is the mutual fund industry coping with alternative assets such as cryptocurrencies?

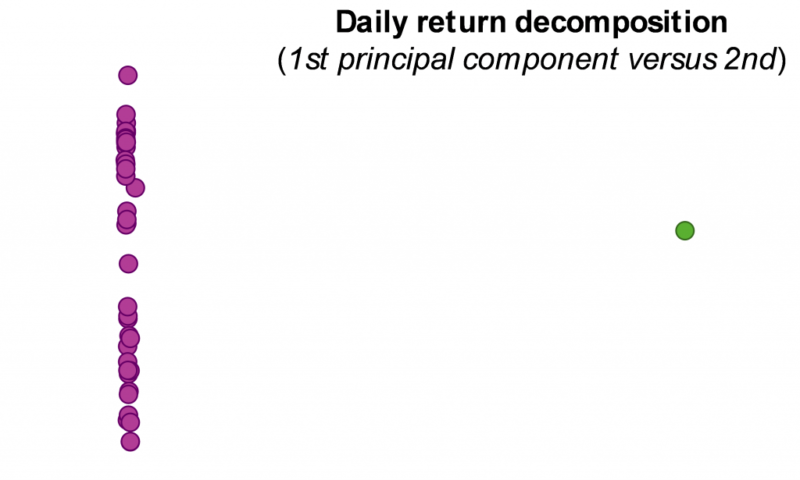

The past 18 months have seen a sharp increase in the number of mutual funds and ETFs with cryptocurrency mandates and an even sharper increase in net flows to these funds. But inflows of the intensity we’ve been seeing into an established fund group, such as those dedicated to municipal and high yield debt, would have a measurable impact on EPFR’s momentum, rotation and crowding models. That, we aren’t seeing. Certainly, within the mutual fund and ETF universe bitcoin remains a highly uncorrelated asset. Principal component analysis (PCA) of fund group returns, for instance, generated the following chart (bitcoin is the green dot):

How is yield hunger playing out? Are hedge funds the main beneficiaries?

After a strong second half to last year, flows to high yield bond funds have lost momentum this year and flows to emerging markets bond funds levelled off in February. However, investor interest in both equity and bond hedge funds remains high. Boosting net returns by cutting costs continues to be a popular strategy. The ETF universe tracked by EPFR hit $7 trillion in AUM last summer and climbed past the $8 trillion mark this February. One small but rapidly growing class of funds is collective investment trusts, better known by the acronym CIT. Like ETFs and mutual funds, CITs are pooled investment vehicles. Unlike ETFs and mutual funds, CITs are not regulated by the SEC and not open to retail investors (though they can get access through qualified retirement plans). For providers, this lighter regulatory touch means that CITs are easier to open, have smaller compliance burdens, and – often – charge lower fees.

White paper: “A rising tide lifts some (Japanese) boats: The Bank of Japan’s ETF purchases and their impact on market signals for individual stocks” is available to Hedge Funds Club readers here: https://pages.financialintelligence.informa.com/epfr-bank-of-japan-paper?utm_source=HFC&utm_medium=BOJ_Paper&utm_campaign=FreeDownload